tax shield formula cpa

C net initial investment T. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above formula.

Interest Tax Shield Interest Expense Tax.

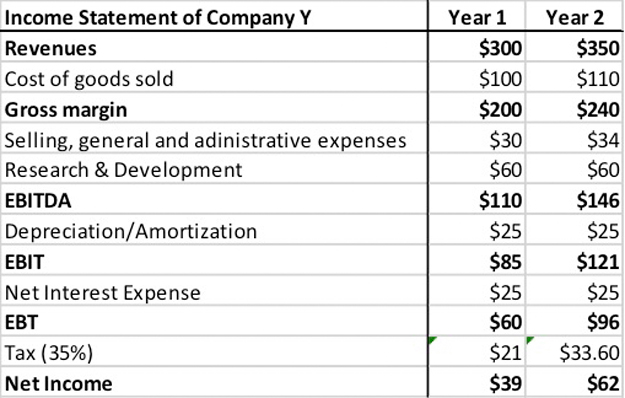

. Let us look at a detailed example when a company prepares its tax income 1 accounting for depreciation expense and 2 not. Calculation of the tax shield follows a simplified formula as shown below. We Help Service Businesses By Finding New Customers and Managing Them Better.

The tax shield Johnson Industries Inc. The Service has issued an industry director directive IDD LMSB-04-0807-056 on contractual allowance issues in the. Ad Honest Fast Help - A BBB Rated.

Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40 The Tax Shield will be Tax Shield 12000 Therefore XYZ Ltd enjoyed a Tax. Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. Kautter CPA Ernst Young LLP.

This is usually the deduction multiplied by the tax rate. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Calculating the tax shield can be simplified by using this formula.

C net initial investment T corporate tax rate k. Or the concept may be applicable but have less. 100 Money Back Guarantee.

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new. Tax Shield 8000 45000 30 15900 So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing. Tax Shield Deduction x Tax Rate To learn more.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. As such the shield is 8000000 x 10 x 35 280000. Get a Free Quote Today.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. This is equivalent to the 800000. The formula for calculating a depreciation tax shield is easy.

Tax Shield Deduction x Tax Rate. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective. Net Cash from Purchase Option Net Cash Before Transaction Purchase Price of Asset depreciation Tax Rate Net Cash from Purchase Option 70000 40000 40000 20.

The effect of a tax shield can be determined using a formula. Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If. Thus if the tax rate is 21 and the business has 1000 of interest.

Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage. Depreciation tax shield 30 x 50000 15000. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

For this we need the sum of taxable expenses and the tax rate. 4 Finance Accounting Salaries provided anonymously by US Tax Shield employees. What salary does a Finance Accounting earn in your area.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. The applicable tax rate is 37. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250.

Tax Shield formula Tax Shield Amount of tax-deductible expense x Tax rate For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax. The effect of a tax shield can be determined using a formula. CCA Tax Shield Notes - Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax rate 10 discount rate Year UCC CCA.

100 Money Back Guarantee. For instance if a company pays 2000 as interest on a loan. A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAI CE Investment Cost Marginal Rate of Income tax Rate of Capital.

How to Calculate Tax Shield. This is usually the deduction multiplied by the tax rate. 𝐶𝑑𝑇115𝑘 𝑑𝑘 1𝑘 CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1.

We can easily calculate the value of a tax shield. Ad Honest Fast Help - A BBB Rated.

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Tax Shield Formula Step By Step Calculation With Examples

How To Calculate Taxes On An Annual Bonus In China 2022

How Is Agi Calculated In Tax Universal Cpa Review

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Times Interest Earned Tie Ratio Formula And Calculator

Modigliani And Miller Part 2 Youtube

Current Yield Meaning Importance Formula And More Finance Investing Accounting Basics Learn Accounting

Tax Shield Definition Formula Example Calculation Youtube

What Is Net Operating Profit After Taxes Nopat Definition Meaning Example

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Disposable Income Formula Examples With Excel Template

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Tax Shield Formula Step By Step Calculation With Examples

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Operating Cash Flow Formula Examples With Excel Template Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)